The strong link between advice and retirement confidence

Seeking professional advice could lead to greater confidence in being financially prepared for retirement.

Vanguard’s inaugural How Australia Retires study has found a strong correlation between the use of a professional financial adviser and retirement confidence.

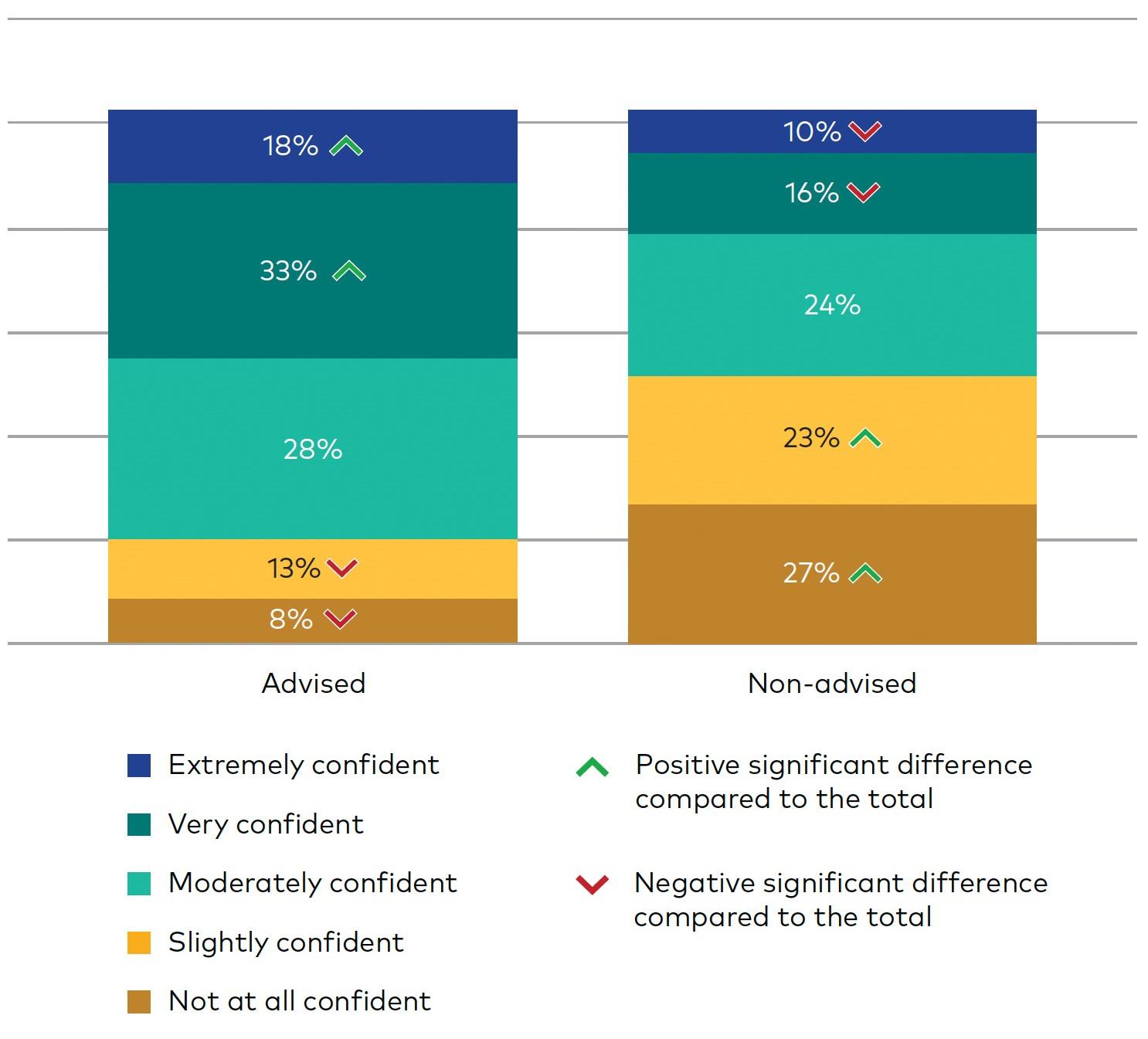

Our survey of more than 1,800 working and retired Australians aged 18 years and older found that, of the people participants who received professional financial advice, 44% indicated they were extremely or very confident in funding their retirement.

These people were also twice as likely to have a clearer, more detailed retirement plan.

But the study also found that almost 2 in 3 working-age Australians (those who did not identify as retired) have never engaged a financial adviser to help map out their retirement strategy.

And, of the Australians who have never sought any professional advice, only 25% indicated they were extremely or very confident in being able to fund their retirement.

Retirement Confidence

Net Advised: Has an exact plan with all details/has a good idea with most detail

51%

Net Non-Advised: Has an exact plan with all details/has a good idea with most detail

26%

Source: Vanguard

Furthermore, those who had not sought professional advice or sought only the assistance of family and friends tended to have less comprehensive retirement plans.

There were some other interesting findings from our study in terms of where some people are getting advice from.

Working-age Australians, particularly those with low retirement confidence, are much more likely to seek information from digital sources including podcasts, blogs, and social influencers.

That contrasts with retired Australians and those with high retirement confidence, who predominantly consult professional sources of guidance, such as financial advisers or their superannuation fund.

Budgeting and regular savings

Working-age Australians who did not seek professional advice and developed their own financial plan are relatively likely to have prioritised budgeting and regular savings.

In contrast, people who have a more detailed plan from an adviser have typically taken more purposeful action to prepare for retirement, particularly in debt management and budgeting. They are more likely to make additional superannuation contributions and invest in securities and property, the study found.

In fact, contributing regularly to superannuation is a key trait of Australians who presented as having high confidence about their retirement.

Conversely, the majority of people presenting as having low retirement confidence typically did not do so.

Vanguard Australia’s Managing Director, Daniel Shrimski, says the study highlights both the opportunities and challenges facing Australians on their journey towards retirement.

“One of the key findings in this report is that having a well-documented and detailed financial plan is one of the most effective ways to not only achieve a successful retirement, but to alleviate the emotional burdens and anxieties that Australians can feel towards retiring,” Mr Shrimski says.

To read the full How Australia Retires study, click here.